Case Studies

The Right Product, at the Right Time, for the Right Reason

Situation

Friends Fran and Anna approached Cove for help. They’d been working with a Financial Therapist we know to help understand their financial position. The therapist recommended they talk to us regarding their recent insurance purchase through a third party.

Several years ago, Fran and Anna had decided to build a carriage house to further enhance the value of their property and provide a second source of income. To build a carriage house, they needed to obtain a mortgage on their property in the amount of $600,000. To protect their asset and ensure that there would be no financial burden should one of them pass away, they decided to purchase life insurance. At that time, they were working with an investment advisor they trusted. This advisor referred them to an insurance specialist inside their firm.

Fran already had a Whole Life insurance policy that was purchased by her parents when she was young. At this time, she was not taking full advantage of the cash value inside the policy and did have room to add more cash to it, should she wish.

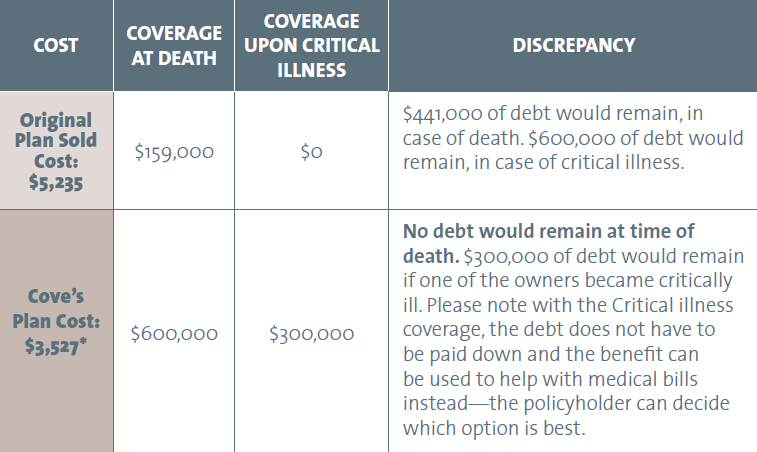

The referred third party insurance specialist told them that they each needed to buy a $159,000 Whole Life policy at a cost of $5,235 pear year. They did as advised.

Challenge

Fran and Anna required coverage to pay off the mortgage, in the case of a catastrophic event, such as death or critical illness. The objective was to pay off at least half the mortgage as soon as possible. This way, should a catastrophic event occur, the surviving friend (or the friend who isn’t facing a critical illness) would be either debt free or in the same debt position.

Our Recommendations/Solution

A year after purchasing the policy, Fran and Anna were referred to Cove to review their insurance, as the Financial Therapist they were working with felt that the insurance was not appropriate for their situation. Upon review, we had several questions for the clients:

-

- Do you know why you purchased a Whole Life policy?

- Were you shown a variety of options prior to purchasing the Whole Life policies?

- Did the Whole Life policies include any term insurance riders to bring up the death benefit of the policy?

We explained to the clients that mortgage insurance coverage is a short-term need and should be covered by a short-term insurance policy. Long-term needs—such as Capital Gains Tax upon death, legacies, or long-term investment strategies—should be covered by a long-term policy. As their need was of a short-term nature, a Whole Life policy was not appropriate. It would be better to invest in a short-term policy—term coverage where the premium remains the same for 20 years, then increases in price.

The cost for a short-term policy for $600,000, which would pay off the entire mortgage, was $905 per year. When compared to the Whole Life policies the friends had purchased, switching to a short-term policy would save them over $4,330 per year. Not only, then, did the Whole Life policy fall short of the coverage needs of the client, but it was costly and not appropriate for the need.

The first insurance specialist, who sold them the Whole Life policy, made no recommendations for the purchase of a product to cover them, should one of them become critically ill. If the friends wished to obtain coverage for critical illness, they could purchase $300,000 of Term 20 critical illness coverage at a cost of $2,622.00 per year. This would mean that they would have appropriate coverage and still save $1,708 per year.

The following table shows the outcomes of both recommendations:

*Costs were determined at time of consultation and can change based on age and health.

Conclusion

Always make sure that you ask for options regarding coverages available. It’s important to know if your need is long term or short term, and only purchase a product that suits the need. Consider getting a second opinion before purchasing a Whole Life type product to ensure you’re getting the product that’s appropriate for you. Be aware, ask questions, seek advice from peers, and—if you aren’t sure the product is right for you—come talk to us. Cove will provide you with options.