Cove Insight: Industrial Alliance Insurance Announces 2023 SRDA Guaranteed Interest Rate

The dramatic losses in the bond and equity markets have impacted life insurance policy interest rates for all smoothed-rate accounts. For Industrial Alliance Genesis IRIS policies invested in the Smoothed Return Diversified Account (SRDA), the guaranteed SRDA interest rate for 2023 is 3.4%, down from 3.5% in 2022.

The main factors accounting for the net decrease in the credited rate for 2023 are a rise in bond rates, the timing of new deposits in recent years with resulting bond purchases in a low-interest rate environment, and the impact of the smoothing formula.

Industrial Alliance Smoothed Return Diversified Account (SRDA)

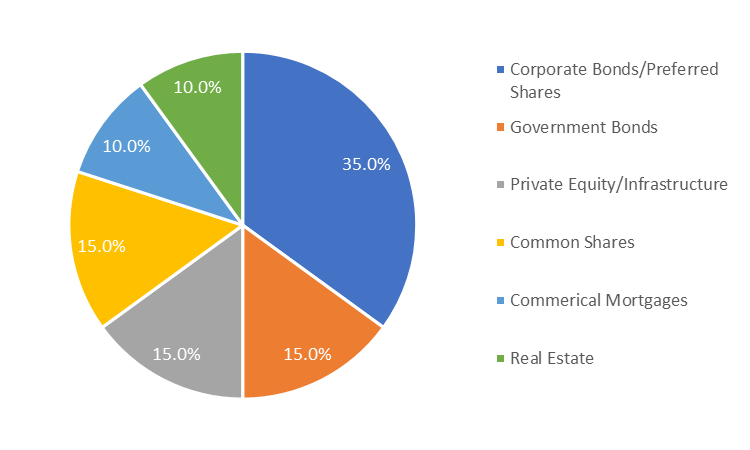

The SRDA investment strategy is centred around a diversified asset allocation, designed to provide attractive long-term return potential.

The objective of the fund is to optimize the asset allocation to provide attractive long-term return potential while minimizing risks through an actively managed approach to investment diversification.

To optimize the risk/return relationship, in addition to its fixed income securities and equities, the fund includes such assets as commercial mortgages, private debt, real estate, and private equity & infrastructure, which offer various advantages, including higher returns with equal or lower risk, a low correlation with traditional asset classes, and additional portfolio diversification.

The SRDA declared rate is based on returns earned on the fund assets to which Industrial Alliance applies a smoothing formula. This formula amortizes the major fluctuations in returns (positive and negative) and provides a stable, low-volatility declared rate from year to year.

Target Asset Mix of the Fund

If you have questions, thoughts, or want to talk more about this topic with one of our advisors, you can book a meeting with us.