Cove Insight: Industrial Alliance Insurance Announces 2023 EquiBuild Fund Guaranteed Interest Rate

For Industrial Alliance (IA) EquiBuild policies, the EquiBuild Fund declared rate for 2023 has increased to 5.1%, up from 4.75% in 2022. Consequently, the rate credited to funds invested in the EquiBuild Account has increased to 3.6%, up from 3.25% in 2022.

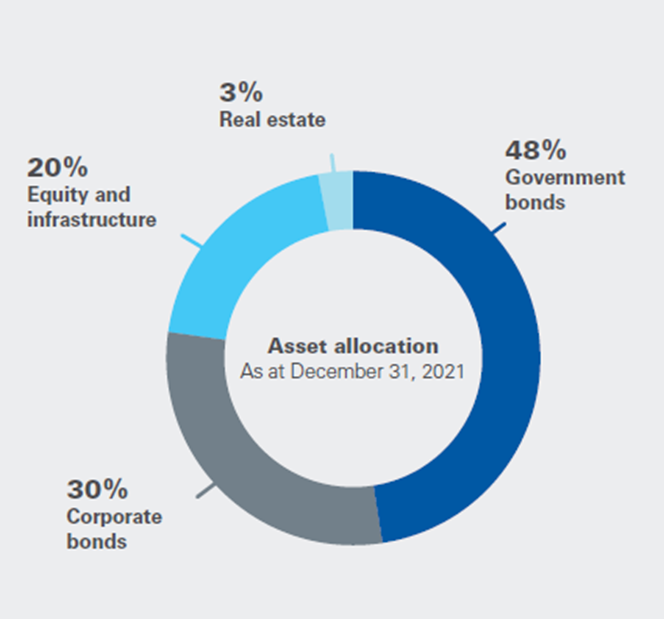

The EquiBuild Fund rate increase comes from the revision of the fund’s target asset allocation and of the smoothing formula applied to the returns earned on the fund’s assets.

The fund’s new target asset allocation was determined as part of the company’s asset strategy review. This new allocation comprises an increase in the proportion of non-fixed income, which will provide your cash values with an enhanced growth potential while maintaining a prudent and diversified investment approach.

The new smoothing formula is based on IA’s long-term return expectations related to the new asset allocation, while continuing to amortize major fluctuations in the fund’s actual returns, whether positive or negative in comparison to the credited returns. The main objective remains to provide a stable, low-volatility declared rate from year to year.

The declared EquiBuild fund rate is set in December of each year and is guaranteed for the following calendar year.

How does the EquiBuild Fund increase EquiBuild policy cash values?

All EquiBuild policyholders benefit from the returns of the EquiBuild Fund through the Equibuild Bonus. Clients can also invest policy cash value in the EquiBuild Account for which the EquiBuild Fund is the underlying fund.

Each year, your policy will receive a bonus if the EquiBuild Fund declared rate in effect on the policy anniversary exceeds 3.5%. The bonus percentage for 2023 is 1.6% as the portion of the EquiBuild Fund declared rate that exceeds 3.5%. The bonus is calculated yearly and equals the bonus percentage multiplied by the average guaranteed cash surrender value for the prior year.

Cash value invested in the EquiBuild Account will earn interest at the new crediting rate of 3.6% starting on January 1, 2023. The interest is compounded daily and credited to the EquiBuild Account on each Monthly Anniversary.

Industrial Alliance Equibuild Fund

The objectives of the fund are to optimize the asset allocation to earn long-term returns superior to those on guaranteed investment accounts while maintaining an appropriate risk level that will provide long-term returns stability.

The Equibuild Fund is invested primarily in high-quality fixed-income securities, equities, and infrastructure, as well as iA Financial Group real estate securities.

The historic performance of the EquiBuild Fund is as follows:

If you have questions, thoughts, or want to talk more about this topic with one of our advisors, you can book a meeting with us.