Cove Insight: Industrial Alliance Insurance Announces 2023 SRIA Guaranteed Interest Rate

The dramatic losses in the bond and equity markets have impacted life insurance policy interest rates for all smoothed-rate accounts. For Industrial Alliance Genesis IRIS policies invested in the Stabilized Rate Investment Account (SRIA), the guaranteed SRIA interest rate for 2023 is 2.5%, down from 2.75% in 2022. As a result, the CLF loan rate for 2023 will decrease from 4.25% to 4.00%.

The 2.5% rate in 2023 is still a highly attractive guaranteed tax-exempt interest rate.

The main factors accounting for the net decrease in the credited rate for 2023 are a rise in bond rates, the timing of new deposits in recent years with resulting bond purchases in a low-interest rate environment, and the impact of the smoothing formula.

Industrial Alliance Smoothed Return Diversified Account (SRIA)

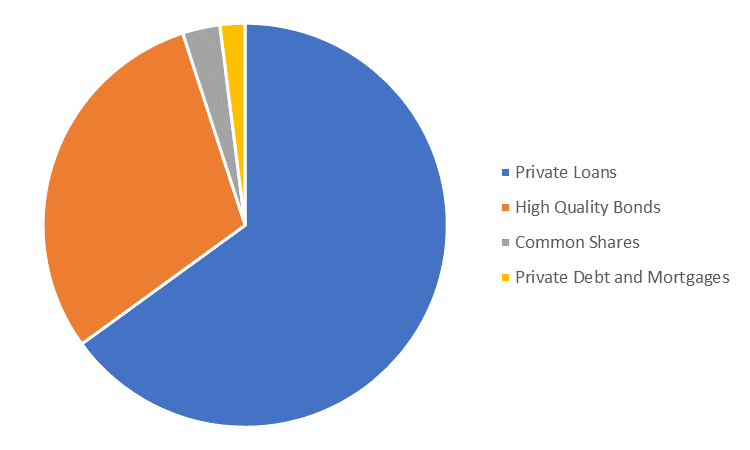

The SRIA fund is managed with a longer-term investment focus, designed to achieve superior returns while minimizing the potential for capital loss within the fund. The portfolio of assets in the funds is comprised of high-quality fixed-income investments such as bonds and commercial loans, with the balance invested in selected equities. The annual SRIA credited rate is determined using a specialized smoothing formula developed by Industrial Alliance. The objective of the smoothing formula is to significantly reduce yield volatility.

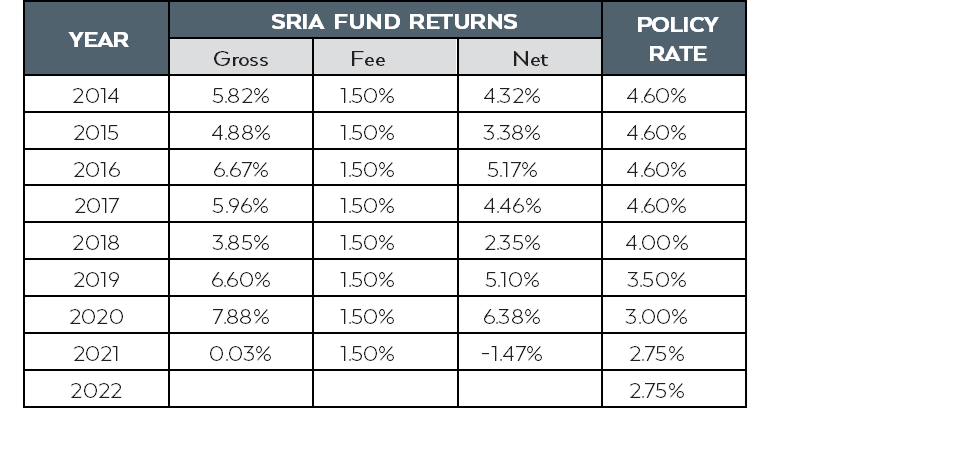

The historic performance of the SRIA Fund is as follows:

As of October 31, 2022, the total asset value of the SRIA was $762 million. At that date, approximately 65% of the assets were invested in private loans, 30% in high-quality bonds, 3% in common shares, and 2% in alternative assets (private debt and mortgages). The average duration of the bonds is approximately ten years.

If you have questions, thoughts, or want to talk more about this topic with one of our advisors, you can book a meeting with us.