iA Financial Withdraws Flagship “Legacy” Policy Applications Close May 29, 2026

iA Financial is closing sales of its “Legacy” life insurance policy on May 29, 2026. Business owners and entrepreneurs should be aware of this short window of tax and estate planning opportunity to acquire Canada’s first and only experiment with a “hybrid” life insurance policy that combines the best elements of universal life and participating whole life insurance policies into one policy contract.

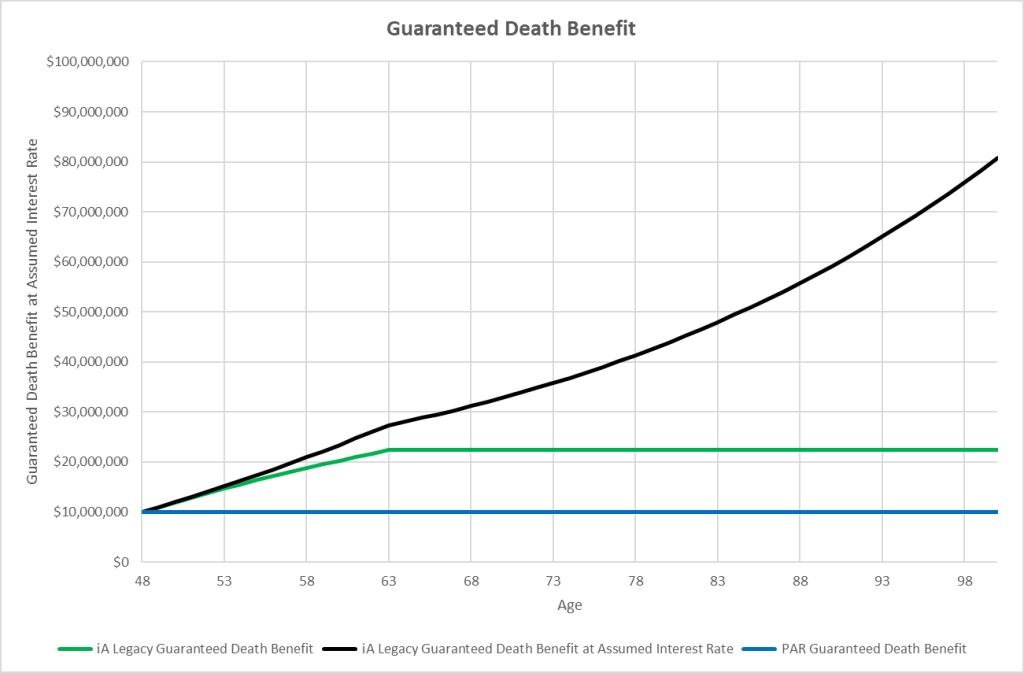

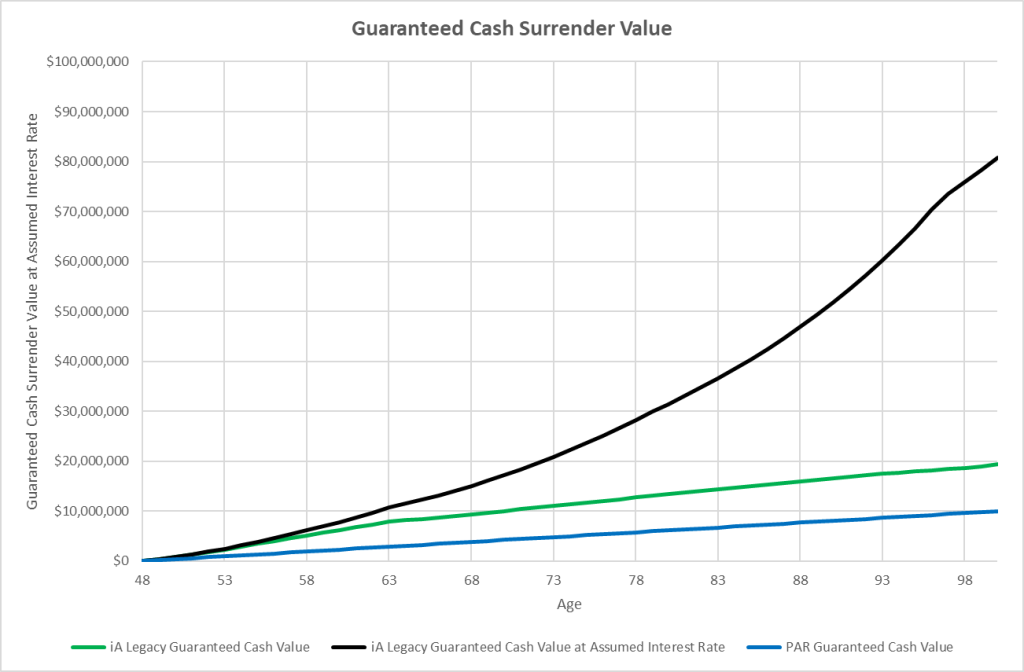

Launched in 2015 under the EquiBuild brand name, it’s successor Legacy delivers guaranteed increasing death benefits and guaranteed increasing cash surrender values far greater than the guaranteed values of any other life insurance product in Canada.

iA Financial has not disclosed any reason for cancelling sales of Legacy. However, in 2020, iA Financial launched iA Par, their first participating whole life policy with traditional guarantees to policyholders. iA Par premiums are the same or more than Legacy yet iA Par delivers less guarantees to policyholders and therefore incurs less risk to iA.

Business owners in need of a new or enhanced tax and estate planning solution involving life insurance should act now on this short window of opportunity before applications close on May 29, 2026. The guaranteed values are compelling.

What is Legacy?

Legacy belongs to the “Whole Life” category of life insurance products that can be described as providing permanent life insurance coverage that requires a minimum annual premium for life plus optional additional premiums in exchange for a death benefit or cash surrender value, both of which increase annually.

Whole Life insurance contracts include guaranteed amounts of death benefit and cash surrender value, plus additional non-guaranteed amounts of death benefit and cash surrender value awarded by the insurer each policy year.

What is the Legacy advantage?

Due to the strong contractual language that includes formula’s and factors for the purchase of Paid Up Additions, the guaranteed amounts of death benefit and cash surrender value in Legacy are significantly superior to anything we have found in the competition including iA Par. The following example illustrates the distinction, and our research suggests that this example is universally applicable.

EXAMPLE: Male Age 50 & Female Age 48 – $10,000,000 Joint-Last-To-Die Coverage¹

1 – Comparing iA Legacy illustration and Whole Life Par illustration for a male age 50 & female age 48, joint-last-to-die coverage with annual premiums of $404,249 for life plus $785,631 additional annual premiums for the first fifteen years.

Is There Still an Opportunity?

At first iA wanted to close the opportunity for new applications immediately. Through discussions with them we were able to get an extension until May 29, 2026. If you are looking for a cash value life insurance policy to address your estate planning wishes and would like to have the product that iA has deemed too good for the consumer, then reach out to us now to discuss.

No Comments

Sorry, the comment form is closed at this time.